The Fed-Caused Disaster: Malinvestment

By Richard J. Maybury

Reprint from the January 2010 EWR

In the September 1992 EWR, and again in the 2004 revision of my little Uncle Eric book The Money Mystery, I proposed that the conventional view of the Federal Reserve’s monetary policy might be wrong. I suggested what I believe is a more realistic — and chilling — view.

Those projections appear to be coming true now, so it is time for a comprehensive review of what’s happening to us. Keeping this article as scientific as possible, we will begin with…

...two clearly observable facts

The first is that the Federal Reserve creates dollars and injects them into the economy. This is no secret. In Washington, inflating the money supply is considered a good thing; the Fed does it openly and proudly. Google “Federal Reserve money supply data,” and you will find plenty of evidence on the Fed’s own web sites.

The second fact is that, when Fed officials inflate, the new dollars do not descend on the country in a uniform blanket.

For instance, in 2009, when the U S population was 308 million, and the Fed injected an estimated $200 billion into the economy.1 Did someone from the Fed show up at your front door to give each member of your household their shares, $649.34 per person? No? Okay then, we know the money was distributed unevenly. Other people received your shares.

The federal government and mainstream press ignore the implications of this.

Most newly created dollars are injected through the banking system, and no one knows where they end up. All we can say for sure is that you and I do not receive our shares, so our dollars must go somewhere else.

Also, I think it is safe to assume the recipients of the dollars spend them. One transaction after another, the new dollars spread outward from the initial entry points, until they are widely dispersed. (Figure A)

This entry point, or cone of money, is a hot spot. People in the hot spot go on a spending spree.

Businesses see the hot spot and move into it to tap into the increased flow of greenbacks. (Figure B) They acquire new plants, equipment and workers. The tech industries in the 1990s, and real estate until 2008, are examples.

A key point (I’ll italicize key points): the formation of new businesses in the hot spots is not investment, it is malinvestment. It is mistakes made by managers and investors who have been misled by the flow of newly created dollars. These people have been lured into financing enterprises that are in the wrong places doing the wrong things.

Another key point: each injection of new money causes more malinvestment, and this malinvestment needs continued new pourings to keep it alive.

It’s happening everywhere

I am writing here about the US Federal Reserve, but this explanation applies to the behavior of all governments around the world. As of the 1970s, all have issued fiat currencies that can be created without limit.

The money goes somewhere, and wherever it goes, malinvestment accumulates.

Another way to understand this is to ask, why is counterfeiting illegal? After all, what could be more helpful than creating and distributing money?

Supply of dollars up, value of dollar down

Money responds to the law of supply and demand just as everything else does. As the quantity of dollars goes up, the value of each individual dollar goes down, and prices rise to compensate.

That’s inflation. Inflation is not rising prices, it is an increase in the amount of money that causes rising prices.

The government eventually becomes concerned about the fall in the value of the dollar, and tightens the money supply.

The flow of money to the hot spots slows, and the shakeout of the malinvestment begins.

Businesses go broke and workers lose their jobs. (Figure C)

That’s a depression. A depression is the correction period following an inflation. It lasts until the assets of the businesses are sold off and the workers find new jobs.

Usually, when a depression begins, officials panic, and re-inflate. This stops the correction.

That’s a recession. A recession is a depression that has been cut short, by resumption of the inflation.

Summarizing what we’ve covered so far…

…when officials inject money into the economy, this distorts prices and causes business managers and investors, who use prices as guides for decision making, to make mistakes.

Firms are created and expanded, and employees are hired, in areas where they otherwise would not be — meaning in the areas to which the new money is flowing. These mistakes are malinvestment.

The firms and employees in these artificially created hot spots are then dependent on continued injections of money.

This disorganization of firms and employees, caused by the injections, can be called the “injection effect.”

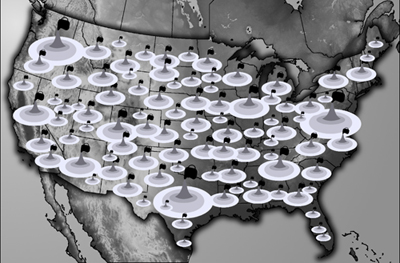

Figure D

Since 1914, the Federal Reserve has increased the money supply from $11.6 billion to $1,695.9 billion. This money went somewhere, and it was not distributed uniformly. It's been creating cones of malinvestment all over the country. America is surely a forest of cones, and all this malinvestment must eventually be shaken out.

To stop the recession, the government resumes its injections. But — another key point — it has little control over where the money goes after the initial pour. Each person’s spending decisions change daily. So —another key — when injections resume, many of the dollars go to new places, creating fresh pockets of malinvestment.

Further, the pockets of malinvestment are not identifiable until the Fed’s counterfeiting stops and the bankruptcies begin. (But it’s not counterfeiting, it’s “monetary policy,” just as the Korean War wasn’t a war, it was a “police action,” and Social Security isn’t a Ponzi scheme, it’s “insurance.”)

Ever-larger additional injections are needed to prop up the malinvestment and prevent depression. The amounts of newly created money, and malinvestment, spiral upward.

Let me emphasize, in 2009, no one from the Fed gave you your $649.34, so you know for a fact that the newly injected money is distributed unequally, and therefore has uneven effects.

It creates cones. (Figure D.)

The conventional view…

… of the government’s monetary policy is that officials try to inflate the money supply at a rate that will keep us in a safe zone between inflationary boom and deflationary bust. (Figure E.)

If they print less money — meaning if they “tighten,” as in 2004 to 2007, — we get a recession. If they print more, as in 2001 to 2004, — meaning if they “loosen” — we get a double-digit inflation, meaning prices rising at more than 10% per year. (The prices do not need to be those of consumer goods, they can be of stocks, real estate, raw materials, or anything else, depending on where the money flows to. Usually it flows into whatever firms and investments are fashionable.)

I believe the assumption that the lines between boom and bust are parallel is based on an unwillingness to face the fact of malinvestment.

I am now 99% sure that in 1992, I was right. The sides of the monetary policy channel are not parallel, they converge. (Figure F.) As the malinvestment grows, so does the amount of money needed to prop it up. The Fed’s maneuvering room eventually disappears. Any injection big enough to avert a depression will lead to runaway inflation.

Please read that last sentence again. I think it describes where America is now, and it is my main point.

When I last wrote about this in September 2008, I suspected that the disaster I had been writing about since 1992 had finally arrived. Now I think that suspicion was right. The Fed has run out of maneuvering room. Its 96 years of creating money out of thin air — which means 96 years of creating malinvestment — have finally put us in a situation where the choice is no longer between double-digit inflation and recession, it’s between triple-digit inflation and depression.

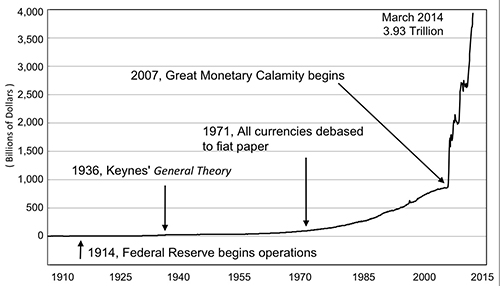

Monetary Base of the U.S. Dollar

Source: Federal Reserve Bank of St. Louis

As you can see from the Monetary Base chart, when the recession arrived in Dec '07, the US Federal Reserve under Ben Bernanke went stark raving mad printing dollars.

So, we're not in Kansas anymore. No informed person trusts the US dollar, and the fiat currency system is dying, as the gold standard died in the 1930s, and Bretton Woods in the 1970s.

When a government demolishes its monetary system, the result is never tranquil, and the US government is now in the process of demolishing the monetary system of the entire world. What will happen, no one knows.

I suggest you keep your powder dry, and if you don't own some gold or silver coins, you should.

In short, I think the odds are very high that if they print enough money to keep the depression from happening, they will send the dollar into a hyperinflation like the one in 1779, when George Washington wrote, “a wagon load of money will scarcely purchase a wagon load of provisions.”2

The main sticking point…

…is that no one knows where all the money goes, so the malinvestment is not identifiable until the counterfeiting stops and the wave of bankruptcies begins. We cannot foresee which businesses will go under or who will lose their jobs, so the political pressure from all quarters to continue counterfeiting dollars is overwhelming.

There is no easy way out of this mess — no way to make a fresh start — without a colossal shakeout of the existing malinvestment.

Very likely, after 96 years of Fed counterfeiting, there are whole cities in the wrong locations.

It takes a lot of newly created dollars to keep this malinvestment alive. The money supply when the Fed began operations in 1914 was $11.6 billion. Today it is $1,695.9 billion 3 —a 145-fold increase.

When the Fed’s counterfeiting stops, the flow of new dollars to these assets will, too. The cones will dry up, and prices of the assets in the cones will plunge to their real values. The only way to delay this disaster is to continue the counterfeiting, which is what the Fed is doing.

In other words, the Fed is the Hurricane Katrina of the economy. These arrogant, socialist Fed power junkies have locked us into a runaway inflation. In the past 18 months alone, they’ve increased the money supply 24%. And, the Monetary Base, which is the raw material from which the money supply is made, has been increased 129%. Much of the Base is still in the banking system.

For investors, buying non-dollar assets is paramount. (See the 10/09 EWR.) However…

…stay cautious

In 1979, Fed chief Paul Volcker took office as the dollar was headed down the tubes. Volcker decided to save the greenback by tightening monetary policy severely. This drove interest rates beyond 15%. Non-dollar assets crashed, and most were moribund for two decades.

I think there is a 30% chance of the Volcker episode being repeated, so don’t bet the farm on non-dollar assets. The strategy that makes the most sense to me is the Permanent Portfolio and Variable Portfolio plan explained in Harry Browne’s Fail Safe Investing. The little book only takes about 45 minutes to read.

Harry’s main point is the same as mine — diversify, diversify, diversify — and he shows you the investment mix that is as close to bulletproof as anything I’ve ever seen, while allowing room for speculation in nondollar assets if you so desire.

Note this: when Volcker began tightening to save the dollar in 1979, the unemployment rate was 6.0%, and it topped out at 10.8%. If Fed officials tighten now to save the dollar, they’ll be starting with joblessness at 10.0%. This means, in my opinion, if they tighten they will be flirting with massive social upheaval, and they know it, so they are sacrificing the dollar to buy as much time as they can, hoping they will be out of office before the catastrophe arrives.

In short, over the past 96 years, Fed officials have created so much malinvestment that their only choice now is between big riots today and even bigger ones tomorrow. The fact that they are continuing their loose dollar policy to keep the malinvestment alive as long as possible means they have chosen the bigger riots tomorrow.

Summary

If you did not receive your share of the Fed’s freshly created dollars last year, then that’s your proof the Fed’s newly minted greenbacks are not distributed uniformly. Some parts of the economy receive more than others, and these areas become hot spots, or cones.

My main point about all this is that the government and mainstream press do not want to acknowledge that inflating the money supply causes malinvestment. That’s the key to understanding the whole mess, malinvestment — the cones. In its 96 years of behaving like a counterfeiter, the Federal Reserve has undoubtedly misled tens of thousands of businesses, large and small, into locating in the wrong places, doing the wrong things, at the wrong prices. This malinvestment must be shaken out before we can make a fresh, non-inflationary start.

Keeping it all alive requires mountainous injections of newly created money, which is nearly certain to destroy the value of the dollar.

I think much of the rest of the world has figured this out, which is why they have been scolding US officials, and openly searching for ways to escape from the dollar, including buying non-dollar assets such as gold, silver, platinum, oil, and other tangible investments. (See my video “How to buy precious metals” on our YouTube.com channel.)

This is why I have recently raised my estimate of the global velocity of the dollar. Many foreigners are clearly trading away their dollars as quickly as they can. But, as usual, Americans remain oblivious. Most Americans graduate from high school or college knowing nothing about currencies.

Again, if no one from the Fed handed you your share of the fresh greenbacks in 2009, then you know the newly created dollars are not distributed uniformly. And, knowing this, you can reason out the implications, which are profound. They are why, for us ordinary mortals who don’t work for the Federal Reserve, counterfeiting is illegal.

I hope you own a lot of non-dollar assets.

1 M1. St. Louis Federal Reserve web site.

2 The Power To Coin Money: The Exercise Of Monetary Powers By The Congress, by Thomas Frederick Wilson, M.E. Sharp publisher, 1992, p.67.

3 M1. St. Louis Federal Reserve web site.

Copyright ©2025 Henry Madison Research, Inc. | P.O. Box 84908, Phoenix, AZ 85071 | 800-509-5400 | A Proud U.S. Company